Andreessen Horowitz (a16z) is one of the most renowned venture capital firms in Silicon Valley, founded by Marc Andreessen and Ben Horowitz in 2009. Over the years, the firm has made significant investments in groundbreaking startups, shaping the landscape of technology and innovation.

However, like any venture, Andreessen Horowitz has faced its fair share of failures and setbacks. In this article, we look into the top eight failures encountered by Andreessen Horowitz. We’ll also cover how the firm navigated through them, ultimately emerging stronger and more resilient.

8 failures of Andreessen Horowitz and how the company overcame them

1. Adapting to technological disruptions

The technology landscape is constantly evolving, and Andreessen Horowitz has had to adapt to technological disruptions that have reshaped industries and business models. Failure to anticipate and respond to these disruptions has resulted in missed opportunities and diminished returns in some cases.

Overcoming this failure:

Andreessen Horowitz embraced a culture of continuous learning and innovation, staying abreast of emerging technologies and market trends. The firm invested in building expertise in areas such as artificial intelligence, cryptocurrency, and decentralized finance, positioning itself at the forefront of technological innovation.

2. Missing out on early investments

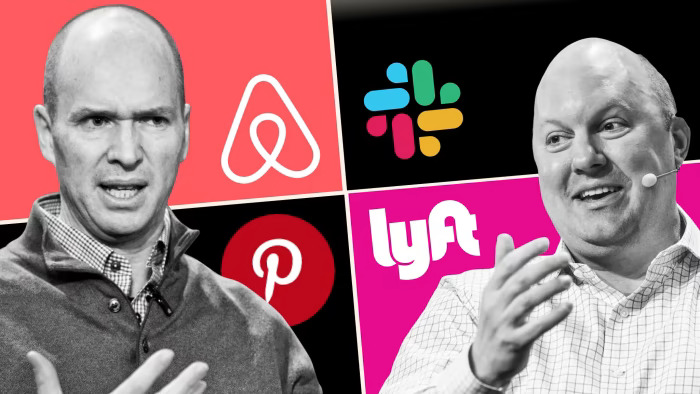

One of Andreessen Horowitz’s early failures was missing out on key investments in companies that later became tech giants. For instance, the firm passed on investing in:

-

Airbnb

In the early days of Airbnb, Andreessen Horowitz opted not to invest in the home-sharing platform, failing to recognize its disruptive potential. The decision proved costly, as Airbnb went on to become one of the most valuable privately held companies in the world. The a16z team underestimated the scalability and market demand for a platform like Airbnb, focusing instead on more traditional investment opportunities in the tech sector.

-

Snapchat

Andreessen Horowitz passed on investing in Snapchat during its early stages, underestimating the app’s appeal to younger demographics and its potential for monetization. The firm may have overlooked Snapchat’s unique value proposition and underestimated its ability to capture a significant share of the social media market.

-

Spotify

Andreessen Horowitz declined the opportunity to invest in Spotify during its early stages, despite the music streaming service’s rapid growth trajectory and potential for market dominance. The firm’s investment criteria at the time may not have aligned with the music streaming industry, leading to a lack of foresight regarding Spotify’s long-term viability and revenue potential.

-

Blockchain and cryptocurrency businesses

Andreessen Horowitz initially approached blockchain and cryptocurrency with skepticism, missing out on early investment opportunities in pioneering projects like Bitcoin and Ethereum. The firm may have been cautious about the regulatory uncertainty and technical complexities surrounding blockchain technology and cryptocurrencies. This led to a reluctance to invest in the nascent industry.

Overcoming this failure:

Instead of dwelling on missed opportunities, Andreessen Horowitz learned from these experiences, refining its investment strategy and becoming more proactive in identifying promising startups. The firm implemented rigorous due diligence processes and expanded its network to ensure it wouldn’t overlook potential unicorns in the future.

3. Managing investor expectations

As a high-profile venture capital firm, Andreessen Horowitz faces pressure to deliver consistent returns to its limited partners (LPs). Managing investor expectations and balancing risk and reward can be challenging. The team at Andreessen Horowitz admits that there are times when they could have done better at this, particularly in volatile market conditions.

Overcoming this failure:

Andreessen Horowitz prioritized transparency and communication with its LPs, providing regular updates on investment performance and market trends. The firm also diversified its fundraising efforts, attracting a mix of institutional investors, family offices, and high-net-worth individuals to its funds.

4. Regulatory and compliance risks

Navigating regulatory and compliance risks is a constant concern for venture capital firms, particularly in highly regulated industries such as finance and healthcare. Andreessen Horowitz has faced challenges in navigating complex regulatory landscapes, resulting in delays and uncertainties for certain investments.

Overcoming this failure:

Andreessen Horowitz invested in building expertise in regulatory compliance and risk management, leveraging its network of legal advisors and industry experts to navigate regulatory challenges effectively. The firm also advocated for regulatory reforms and worked closely with policymakers to create an environment that is conducive to innovation and entrepreneurship.

5. Challenges in cultural alignment

Investing in startups often involves navigating cultural differences and aligning the values and goals of founders and investors. Andreessen Horowitz encountered challenges in maintaining cultural alignment with some portfolio companies, leading to friction and communication breakdowns.

Overcoming this failure:

Andreessen Horowitz prioritized building strong relationships with founders and fostering a culture of trust and collaboration. The firm invested in building diverse teams and promoting inclusivity, recognizing that cultural alignment is essential for long-term success and sustainable growth.

6. Strategic missteps in portfolio management

Managing a diverse portfolio of startups comes with its own set of challenges, and Andreessen Horowitz has faced strategic missteps in portfolio management. This includes instances where the firm failed to provide adequate support and resources to its portfolio companies, leading to missed opportunities for growth and innovation.

Overcoming this failure:

Recognizing the importance of strategic guidance and operational support, Andreessen Horowitz revamped its approach to portfolio management. The firm established dedicated teams to provide hands-on assistance to portfolio companies, offering expertise in areas such as product development, marketing, and talent acquisition.

7. Investment in failing startups

Not all investments yield positive returns, and Andreessen Horowitz has had its fair share of failures in backing startups that ultimately failed to scale or generate significant revenue. These include companies that struggled with product-market fit, internal conflicts, or mismanagement.

Overcoming this failure:

Andreessen Horowitz learned valuable lessons from these failed investments, emphasizing the importance of thorough due diligence, strong leadership, and market validation. The firm became more discerning in selecting startups, focusing on founders with a track record of execution and disruptive ideas with clear market demand.

8. Overestimating certain markets

Like any venture capital firm, Andreessen Horowitz has occasionally overestimated the potential of certain markets. For example, the firm made investments in sectors that failed to gain traction or faced regulatory hurdles, resulting in underwhelming returns.

Overcoming this failure:

Andreessen Horowitz adapted its investment thesis, shifting focus towards emerging technologies and industries with greater growth potential. The firm diversified its portfolio across sectors such as artificial intelligence, blockchain, and biotech, mitigating risks associated with market fluctuations and regulatory uncertainties.

How Pressfarm can help businesses navigate failure

Venture capital is a dynamic and competitive field. This is where success often hinges on making the right investment decisions and navigating complex challenges. Even renowned firms like Andreessen Horowitz encounter setbacks and failures along the way. However, with the right tools and resources, such as those provided by Pressfarm, venture capital firms and startups alike can overcome obstacles.

What’s more, they can capitalize on opportunities, earn trust, and achieve success in the ever-evolving landscape of entrepreneurship. Here, we’ll explore how Pressfarm can help you overcome the kind of failures Andreessen Horowitz has faced and thrive in the world of venture capital..

-

Networking and collaboration opportunities

Success in venture capital often depends on building strong relationships and collaborations within the industry. Pressfarm facilitates networking and collaboration opportunities through its platform, connecting venture capital firms with the media, other investors, and thought leaders.

-

Thought leadership and content creation

Establishing thought leadership is essential for venture capital firms looking to differentiate themselves in a competitive market. Pressfarm helps you to position yourself as an industry leader through thought-provoking content creation and distribution.

By preparing insightful blog posts, webinars, or guest articles for leading publications, Pressfarm helps industry leaders share their expertise and insights with the broader community.

-

Diversity and inclusion advocacy

Andreessen Horowitz has faced criticism for its lack of diversity in investments, particularly in terms of gender and racial representation. Pressfarm is committed to promoting diversity and inclusion in the venture capital ecosystem. Through initiatives such as diversity-focused media campaigns, startup spotlights, and industry events, Pressfarm can help you amplify your voice and drive meaningful change in the industry.

-

Startup promotion and exposure

For startups seeking investment, gaining visibility and exposure can be a daunting task. Pressfarm provides a platform for startups to showcase their innovations, connect with investors, and attract funding. Through Pressfarm’s startup directory network, founders can create detailed profiles highlighting their products, teams, and achievements. This makes it easier for venture capital firms like yours to discover and evaluate potential investment opportunities.

-

Market insights and analysis

Andreessen Horowitz’s failures often stem from misjudging market trends and underestimating the potential of emerging technologies. Pressfarm provides valuable market insights and analysis to help venture capital firms make informed investment decisions. Through comprehensive research reports, trend analysis, and industry newsletters, Pressfarm equips you with the knowledge you need to identify promising opportunities and avoid costly missteps.

-

Media outreach and public relations

One of the key challenges faced by venture capital firms is effectively communicating their value proposition, especially to potential investors, portfolio companies, and the broader industry. Pressfarm offers a suite of media outreach and public relations services to help firms amplify their message and enhance their visibility.

Using this platform, you can craft compelling press releases and pitch stories to journalists. You can also secure media coverage in top-tier publications. By partnering with Pressfarm, your venture capital firm can build credibility and attract attention in a crowded market.

Pressfarm offers a comprehensive suite of tools and resources to help your venture capital firm overcome challenges. Not to mention, you can leverage it to capitalize on opportunities and achieve success in the dynamic world of entrepreneurship. You can also leverage the platform to gain valuable market insights, enhance media outreach, promote diversity and inclusion, or foster collaboration and networking.

Further, this agency provides you with the support and guidance you need to navigate the complexities of venture capital investment. By leveraging Pressfarm’s expertise and platform, you can overcome the failures of the past and pave the way for a brighter future in the world of investment and innovation.

Final take

Despite facing numerous failures and setbacks, Andreessen Horowitz has demonstrated resilience, adaptability, and a commitment to learning from his experiences. By navigating challenges with strategic foresight, operational excellence, and a focus on long-term value creation, the firm has emerged as a leading player in the venture capital industry.

Aspiring entrepreneurs and investors can draw inspiration from Andreessen Horowitz’s journey. They can recognize that failure is not the end but rather an opportunity for growth and transformation.

FAQs

What does the future hold for Andreessen Horowitz?

Looking ahead, Andreessen Horowitz remains committed to its mission of supporting bold entrepreneurs and groundbreaking innovations. The firm continues to evolve its investment strategy, expand its global presence, and explore new opportunities in emerging technologies and industries.

What advice does Andreessen Horowitz offer to aspiring entrepreneurs and investors?

Andreessen Horowitz advises aspiring entrepreneurs and investors to embrace failure as a natural part of the journey to success. The firm encourages resilience, perseverance, and a willingness to learn from mistakes. It also emphasizes the importance of continuous improvement and adaptation in the fast-paced world of technology.

What strategies does Andreessen Horowitz employ to exit investments successfully?

The firm has developed a robust exit strategy framework tailored to each investment’s unique characteristics. This included exploring various exit options such as mergers and acquisitions, initial public offerings, and secondary market transactions. By carefully evaluating timing and market conditions, Andreessen Horowitz maximizes returns for its investors.