Whether you’re a new business owner, an aspiring entrepreneur, or someone looking to take control of your finances, understanding bookkeeping for business is essential. Today, managing your own accounts has become more accessible and transparent than ever before. In this article, we will explore the importance of bookkeeping and how it can benefit your business by providing a deeper understanding of the numbers that drive it.

Differentiating accounting from bookkeeping

Before diving into the details, it’s crucial to distinguish between accounting and bookkeeping. Although closely related, these two functions have distinct responsibilities. Accounting primarily focuses on tax returns, financial advice, and legal entity structures. In contrast, bookkeeping ensures accurate and up-to-date accounts. It encompasses tasks such as organizing financial transactions, preparing invoices, making payments, and monitoring revenues and expenses.

Bookkeeping plays a critical role in providing real-time numbers that allow accounting to concentrate on strategic operations. Without precise bookkeeping, your business may struggle to thrive in the competitive market.

Harnessing accounting software for bookkeeping

Accounting software has become an essential tool for effective bookkeeping. Platforms like Xero Accounting offer numerous benefits, features, and services that streamline financial management. These software solutions provide flexibility, allowing you to track your business using mobile apps and gain valuable insights into your cash position. Additionally, they integrate with banks, offer data security and protection, simplify invoicing and billing, and provide optimal tools and dashboards.

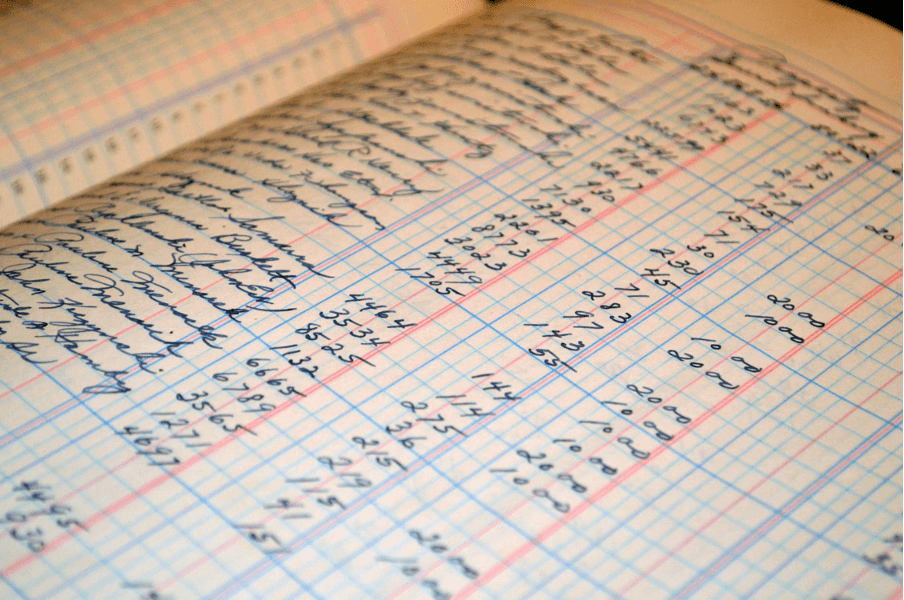

Small businesses, accountants, and bookkeepers rely on these systems to manage their business numbers efficiently. Embracing technology and exploring online accounting courses can revolutionize your bookkeeping practices and eliminate outdated manual processes.

Bookkeeping and tax preparation

Proper bookkeeping significantly eases the process of tax preparation. By maintaining accurate records, bookkeeping lays the foundation for income and expense reporting, profit calculation, and ultimately, filing tax return online.

Neglecting bookkeeping can lead to missed payments and inaccurate records, potentially costing your business on tax returns. Therefore, rely on bookkeeping to prevent discrepancies and provide better records, ensuring smooth tax preparation and compliance. Although the accountants usually prepare financial reports, bookkeepers can do that as well with what is called a management report.

Strategic business insights through bookkeeping

Bookkeeping involves dealing with intricate financial details, making it overwhelming for many business owners. Hiring a professional bookkeeper can alleviate this burden while providing valuable insights for strategic decision-making.

By tracking expenses, budgeting, and maintaining accurate records, bookkeeping empowers you to make informed business decisions. It enables you to project future success, explore new markets, and make strategic investments based on your business’s performance and financial standing. With comprehensive bookkeeping, you gain a holistic view of your business’s health, allowing you to drive growth and navigate challenges effectively.

Cost savings and efficient financial monitoring

In addition to its strategic benefits, bookkeeping can help you reduce costs. For certain businesses, replacing an accountant with a bookkeeper can lead to significant savings. Bookkeepers excel in managing daily transactions and monthly payroll, making them a cost-effective option for smaller businesses.

Even if you handle your accounting, employing a professional bookkeeper provides an extra layer of accuracy when reporting to tax authorities and ensures diligent monitoring of cash flow. By optimizing your bookkeeping practices, you can achieve financial stability and make informed financial decisions for your business’s long-term success.

Conclusion

Bookkeeping is an essential aspect of running a successful business, particularly for small enterprises. It enables you to gain a clear understanding of your company’s finances, make informed decisions, and drive growth. Implementing effective bookkeeping strategies, harnessing accounting software, and leveraging professional assistance can revolutionize your financial management practices. For small businesses, you can use these Quickbooks alternatives to manage your finances for the success of your business.

Embrace the power of bookkeeping to propel your business forward, ensuring accurate records, compliance with tax regulations, and a solid foundation for future growth. Moreover, Quicken, a personal finance tool can help you to manage budgeting and billing in your business.